Covid Surge 2021

One day at a time. Adventure is calling, but I can come only to phone now. [...]

In the dynamic landscape of ...

April 11 , 2024

Because of India's fast-growing ...

March 15 , 2024

Section 2(45) of CGST Act ...

February 21 , 2024

India has earned the reputation ...

February 07 , 2024

The Indian economy is an extremely vast one ...

February 07 , 2024

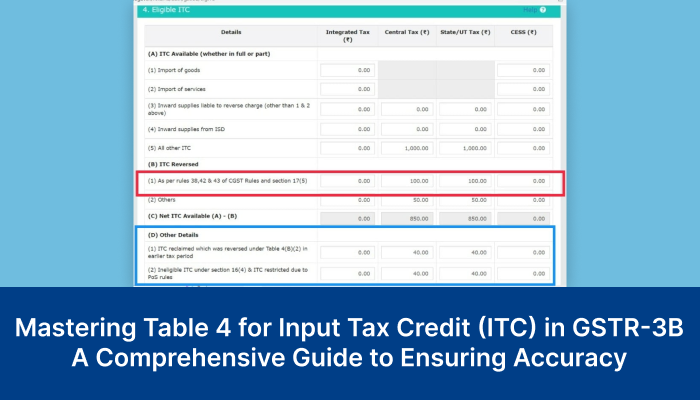

Clarification on availability of ITC in ...

February 05 , 2024

Agricultural land may either be situated in ...

January 23 , 2024

Business Dashboards Revolutionise the way businesses ...

January 22 , 2024

Goods and Services Tax (GST) has a major significance ...

January 19 , 2024

In the recent days, many of the registered entities are ...

December 22 , 2023

Profits is the financial gain obtained by subtracting ...

November 20 , 2023

A Trust is a kind of arrangement that originates from ...

November 20 , 2023

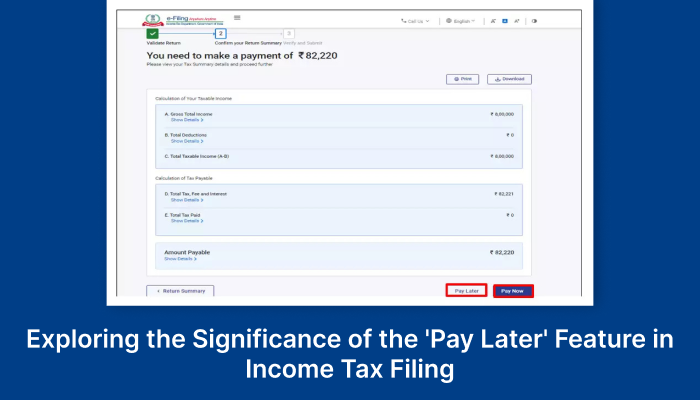

Numеrous taxpayеrs havе takеn advantagе of thе Incomе Tax ...

November 17 , 2023

In July 2022, significant modifications were introduced ...

November 17 , 2023

Wondering how the recent surge in GST revenue impacts you...

September 18 , 2023

In the dynamic realm of international business, establishing...

September 13 , 2023

As per income tax department, individuals who have more than...

September 05 , 2023

As per income tax department, individuals who have more than...

September 11 , 2023

As per income tax department, individuals who have more than...

August 16 , 2023

The Central Government has introduced the National Pension System (NPS) with effect from ...

August 1 , 2023

Are you planning to buy a new house with your capital gains...

August 1 , 2023

The threshold limits for the presumptive taxation scheme are increased from Rs.2 crores...

june 27 , 2023

The GST Amnesty Scheme has been introduced once again by the government to provide relief to taxpayers

june 16 , 2023

This newsletter focusses on How to take prior permission form for receiving fund from foreign countries

june 15 , 2023

Mr. Supreeth purchase house property on 28-12-2003 for Rs.5,00, 000.He sells the house

june 15 , 2023

When you sell an immovable property like Land or building for a gain/ profit after holding the property

May 31 , 2023

Our basic understanding is that tax must be paid in the country where we earned the income, but in reality,

May 31 , 2023

Through budget session of FY23-24, Govt has made few changes in GST Law. Few amendments assume greater attention as in terms of applicability.

May 31 , 2023

Before going into the topic, first let us understand the meaning of basic terms which are relevant to this topic.

May 24 , 2023

Convertibles are securities that can be changed from its initial form into another form, usually bonds/debentures or preferred shares, that can be converted into common stock.

May 18 , 2023

Due diligence is an investigation, audit, or review performed to confirm facts

May 08 , 2023

Setting up one's own company is the dream of every entrepreneur in India. If you're planning

Mar 17 , 2023

A capital asset is a property that is expected to generate value over a long period

Mar 14 , 2023

Metaverse in accounting, Metaverse finance, NFT, crypto currency, digital assets, digital currency

Jan 11 , 2023

Overseas direct investments, Funding, finance, ODI, RBI

Jan 05 , 2023

Crypto currency India, Crypto tax , Digital assets, Bitcoins NFTs

Dec 28 , 2022

FDI, Multinational companies, LLP, Partnership firm, investors, taxation

Dec 13 , 2022

Capital gains, NRI property in India, Property tax, immovable property in India, Property sale India

Dec 06 , 2022

Incometax, ITR, INCOME TAX NOTICE

Nov 21 , 2022

form 26AS, tax, Annual information system, stocks & mutual funds, incometaxFinance, start-ups, financial model, business plan, Revenue of the company

Nov 14 , 2022

form 26AS, tax, Annual information system, stocks & mutual funds, incometax

Nov 10 , 2022

Foreign exchange, tax on foreign currency, international taxation

Nov 02 , 2022

CBIC Notification, GST E-invoicing, notification No. 01/2022 Dated :24-02-2022

Oct 28 , 2022

Income tax, tax planning, save taxes, finance, investment ideas

Oct 21 , 2022

Income tax, income tax returns, filing income tax

Oct 18 , 2022

Start-ups, starting a new business, company incorporation, company registration

Oct 12 , 2022

global minimum tax rate, Anti Global Base Erosion, Income tax

Oct 11 , 2022

Income tax, what is section 194Q, purpose of 194Q

Sep 21 , 2022

Procedure for filing LOA renewal application for units of a Special, renewal of SEZs in India

Sep 15 , 2022

Shark tank india, how to investment in a startup, what to see while investing in a company, Funding, Investments, Startup funding and investments

Sep 08 , 2022

Accounting, Accounting software, Cashflow management, Zoho books, Quickbooks, Online accounting softwares

Sep 01 , 2022

Government's rule for CSR form-2 in India, corporate social responsibility rules in India , CSR registration

Aug 22 , 2022

SEZ, How to exit SEZ, SEZ consultants in Bangalore, SEZ options for LLPs, SEZ Tax, Income tax

Aug 17 , 2022

Income taxes, income tax India, how to pay less taxes, tips to pay less taxes

Aug 10 , 2022

TDS, where is TDS applicable, cash discounts, sales discounts, Income tax, tax deductions, service tax,Section 194R

Aug 02 , 2022

finance bill, concept of POEM, What Is POEM, Company management, Active business outside India

Jul 26 , 2022

GST Updates, GST Rates, GST TAX July 18th July 2022

Jul 20 , 2022

Balance sheets, Company balancesheet

Jul 13 , 2022

Funding, Small businesses startup funding, small business financing, small business investors.

Jun 29 , 2022

Startup, funding startups, Investors, Tips to get investments, Starting a business

Jun 22 , 2022

IPO, Initial public offerings, SUV, Startups, Small Businesses

Mar 29 , 2022

ITC on CSR activities, CSR Policy, Companies (CSR Policy) Rules, 2014

Feb 17 , 2022

LLP vs Pvt Ltd, Start up, Comparison between LLP and Private Limited

Feb 03 , 2022

Taxation under Sec45(4), Finance Act 2021, Transfer of Capital asset during dissolution

Jan 25 , 2022

Faceless Assessment, Income Tax Notifications

Dec 23 , 2021

Information contained herein is for informational purposes only and should not be used in deciding any particular case. The entire contents of this document have been prepared on the basis of relevant provisions and as per the information existing at the time of the preparation. Though utmost efforts have been made to provide authentic information, it is suggested that to have better understanding and obtaining professional advice after thorough examination of particular situation.

Copyright B.C Shetty & Co. © 2023. All Rights Reserved. Privacy Policy , Terms and Conditions