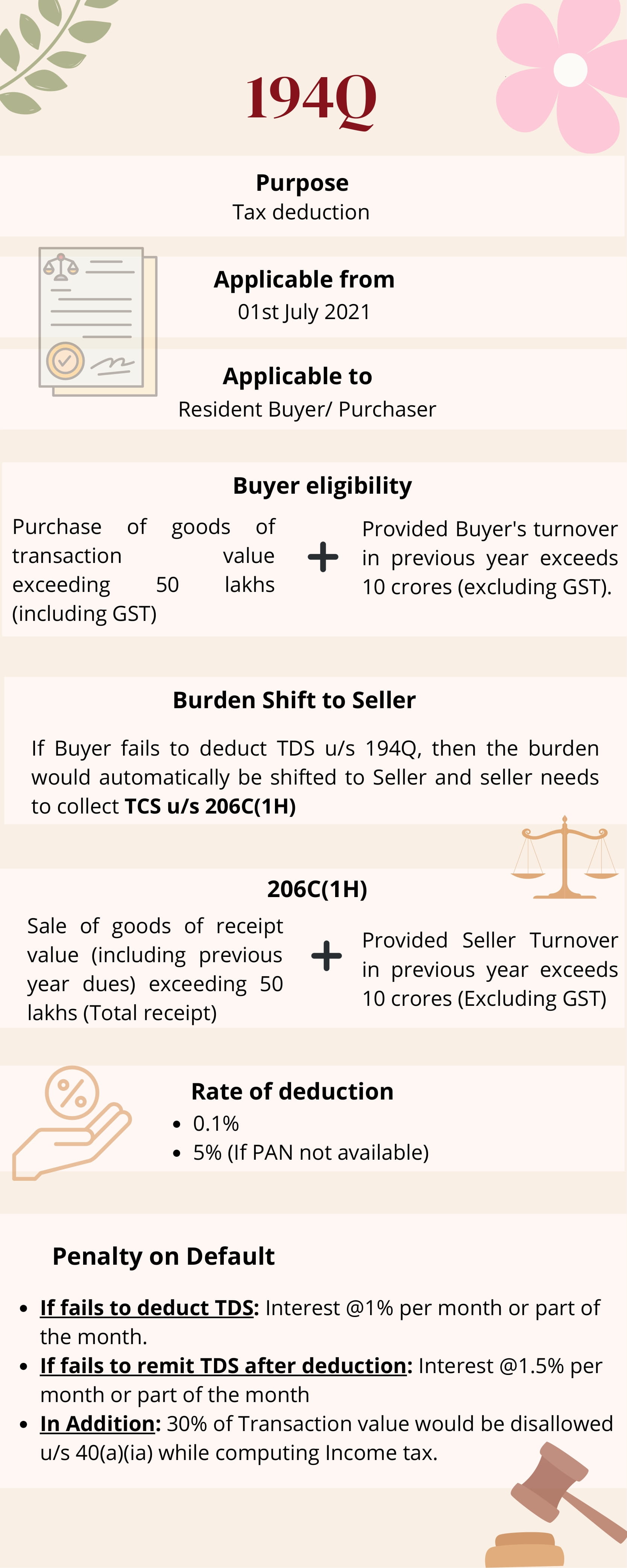

TDS on purchase of goods above 50 Lakhs: Implications Section 194Q of Income Tax Act

Explanation:

• 194Q - Buyer must deduct TDS @0.1% on purchase of goods of transaction value exceeding 50 lakhs if the Seller is Resident of India and Turnover of Buyer in previous year exceeds 10 crores (excluding GST).

• 206C(1H) - Seller must collect TCS @0.1% on sale of goods of receipt value (including previous year dues) exceeding 50 lakhs (Total receipt), provided Seller Turnover in previous year exceeds 10 crores (Excluding GST)

Meaning of “Transaction Value” and “Receipt Value”:

The core difference between Transaction value and Receipt value is based on inclusion of previous year dues received during the year in computing “Receipt value” and excluding the same in computing “Transaction value”.

Concession provided to remove difficulty:

Section 194Q always overrides Section 206C(1H) but as per Circular No.13/2021, if, for any reason, TCS has been collected by Seller u/s 206C(1H), before Buyer could deduct TDS u/s 194Q on the same transaction, TDS not required to be deducted again by Buyer.

The following documents are to be prepared and submitted with the officer while filing the application with DC.

Applicability - Effective from:

194Q applicable on the aforesaid transactions w.e.f 01/07/2021

Note

- The period April 2021 - June 2021 should be considered for computing the threshold limit of 50 lakhs for each seller (including GST)

- Also, if the amount is credited in books of Buyer as suspense account or whatever name called, Provisions of Section 194Q shall apply.

Situations where TDS u/s 194Q not applicable:

Failure to deduct TDS u/s 194Q - Burden Shifted to Seller:

If Buyer fails to deduct TDS u/s 194Q for which it is applicable, then the burden would automatically be shifted to Seller and seller needs to collect TCS u/s 206C(1H)

PAN not available:

If PAN of Seller is not available, then TDS @5% to be deducted u/s 194Q instead of 0.1%

Consequences of Default in deducting/depositing TDS u/s 194Q:

Below table is an example of various possible scenarios for your easy understanding:

Basis of TDS deduction on Adjustment of GST/Other State levies

The above rule applies also in case of Purchase of goods which are not covered by GST, but covered by Other State levies (i.e., VAT, excise duty, etc.)

TDS Adjustment in case of Debit Note/Purchase Return:

In the cases where Debit note is issued for a purchase for which 194Q is applicable,

- If TDS already deducted on purchase prior to return– TDS already deducted may be adjusted against the subsequent purchase from same seller.

- If TDS not deducted on purchase prior to return – No further implications.

Disclaimer:

“The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received, or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of situation.”