Good and Service Tax, 2017 Export of Goods or Services without payment of Integrated

Export of goods or services without payment of IGST

Any registered person availing the option to supply goods orservices forexport without payment of integrated tax shall furnish, priorto export, abond or a Letterof Undertaking. As per Rule 96A clause 6 this is also required in case of provision of goods orservices to SEZ units/developers.

If export of goods or services is being made without payment of IGSTunder Bond or Letterof Undertaking, then only following classes of registered person are allowed to furnish letterof undertaking (LUT):

If taxable person is a status holder (Business leaders in internationaltrade, Export house, Manufacturers who are also status holders) as specified in paragraph 5 of the Foreign Trade

If taxable person has,-

- received the due foreign inward remittances amounting to aminimum of 10% of the export turnoverin the preceding financialyear

- such foreign inward remittances should not be less than one crore rupees, and

- he has not been prosecuted forany offence underthe CGST Act, 2017 or underany of the existing laws in case where the amount of tax evaded exceeds Rs. 2.5 crores.

The registered taxable persons otherthan those specified above are required to execute Bond.

Letter Of Undertaking

Important points to note in case of exports under LUT (LETTER OF UNDERTAKING)

- It should be furnished in the format prescribed in the annexureto FORM GST RFD-11. (Refer Annexure 1)

- It should be furnished in duplicate.

- It shall be valid for 12 months.

- It may be furnished manually to the jurisdictional Deputy/Assistant

- Commissioner till the module forfurnishing of FORMRFD-11 is available on the common portal

- It may be accepted by the jurisdictional Deputy/Assistant Commissioner

- It shall be executed by the working partner, the Managing Directororthe Company Secretary or the proprietororby a person duly authorised by such working partneror Board of Directors of such company or proprietor on the letterhead of the registered person.

- Exports may be allowed underexisting LUTs/Bonds till 31st July 2017. Exporters shall submit the LUTs/bond in the revised format latest by 31st July, 2017.

List of documents required to furnish LUT

- Copy of Status Holdercertificate issued by DGFT/ Development Commissioner Or Bank FIRC of 10% of the export turnoverwhich should not less than 1 crore in financial year

- Letter of Undertaking to be executed on letterhead- to be provided in duplicate; (also to be signed by witnesses)

- Declaration required that the registered has not been prosecuted forany offenceinvolving tax, where the tax evaded is above Rs. 250 lakhs

- Proof to indicate principle place of business- preferably copy of application forregistration for GST;

- FORM RFD- 11 to be provided in duplicate;

- If the taxpayeris a publicorprivate limited company than board resolution forappointment of Authorized signatory is required

Bonds

Important points to note in case of exports under Bond.

- The bond should be in the format prescribed in the FORM GST RFD-11. (Refer Annexure 2)

- It may be a running bond and would coverthe amount of tax involved in the export based on estimated tax liability as assessed by the exporterhimself

- In case of running bond, it is required to be ensured by the exporterthat the outstanding tax liability on exports is within the bond amount.

- In case the bond amount is insufficient to coverthe tax liability in yet to be completed exports, the exporterwill be required to furnish afresh bond to coversuch liability.

- The jurisdictional Commissioner may decide about the amount of bank guarantee depending upon the track record of the exporter.

- If Commissioner is satisfied with the track record of an exporterthen furnishing of bond without bank guarantee would suffice.

- The bank guarantee should normally not exceed 15% of the bond amount.

- The bond shall be furnished on non-judicial stamp paperof the value as applicable in the State in which bond is being furnished.

NOTE:It is furtherstated that the Bond/LUT shall be accepted by the jurisdictional Deputy/Assistant Commissioner having jurisdiction overthe principal place of business of the exporter. The exporteris at liberty to furnish the bond/LUT before Central Tax Authority or State Tax Authority till the administrative mechanism forassigning of taxpayers to respective authority is implemented.

Annexures:

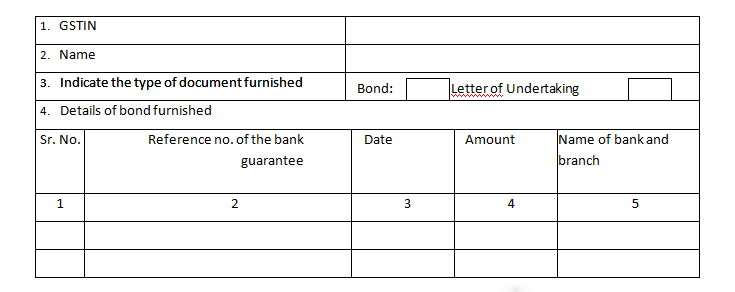

FORM GST RFD – 11

Furnishing of bond or Letter of Undertaking for exportof goods or services

Note – Hard copy of the bank guarantee and bond shall be furnished to the jurisdictional officer.

Signature of Authorized Signatory

Name

Designation / Status -------

Date ----------

Bond for export of goods or services withoutpayment of integrated tax (See rule 96A)

I/We.................of....................,hereinafter called "obligor (s)", am/are held and firmly bound to the President of India (hereinafter called "the President") in the sum of......................rupees to be paid to the President for which payment will and truly to be made.

I/We jointly and severally bind myself/ourselves and my/our respective heirs/executors/ administrators/ legal representatives/successors and assigns by these presents; Dated this...................day of....................;

WHEREAS the above bounden obligorhas been permitted from time to time to supply goods orservices forexport out of India without payment of integrated tax; and whereas the obligor desires to export goods or services in accordance with the provisions of clause (a) of sub-section (3) of section 16;

AND

WHEREAS the Commissioner has required the obligor to furnish bank guarantee for an amount of...............................rupees endorsed in favour of the President and whereas the obligor has furnished such guarantee by depositing with the Commissioner the bank guarantee as afore mentioned;

The condition of this bond is that the obligorand his representativeobserve all the provisions of the Act in respect of export of goods or services, and rules made thereunder;

ANDif the relevant and specificgoods orservices are duly exported;

ANDif all dues of Integrated tax and all otherlawful charges, are duly paid to the Government along with interest, if any, within fifteen days of the date of demand thereof being made in writing by the said officer, this obligation shall be void;

OTHERWISE and on breach or failure in the performanceof any part of this condition, the same shall be in full force and virtue:

AND the President shall, at his option, be competent to make good all the loss and damages, from the amount of bank guarantee or by endorsing his rights underthe above-written bond orboth;

I/We furtherdeclare that this bond is given underthe orders of the Government forthe performance of an act in which the publicare interested;

IN THE WITNESS THEREOF

these presents have been signed the day hereinbefore written by the obligor(s).

Signature(s) of obligor(s).

Date :

Place :

Witnesses

(1) Name and Address

(2) Name and Address

Accepted by me this.............................day of .................. (month)

................ (year) ………………………………..of …………….. (Designation)

for and on behalf of the President of India.".

Letter of Undertaking for exportof goods or services without paymentof integrated tax (See rule 96A)

To,

The President of India(hereinaftercalled the "President"),acting through the properofficer

I/We .................................. of..........................…………… (address of the registered person) having Goods & Services Tax Identification Number No………………………………………… , hereinaftercalled "the undertaker(s) including my/our respective heirs, executors/ administrators, legal representatives/successors and assigns by these presents, hereby jointly and severally undertake on this .................. day of ................... to the President

- to export the goods or services supplied without payment of integrated tax within timespecified in sub- rule (1) of rule 96A ;

- to observes all the provisions of the Goods and Services Tax Act and rules made thereunder, in respect of export of goods or services;

- pay the integrated tax, thereon in the event of failure to export the goods orservices, along with an amount equal to eighteen percent interest perannum on the amount of tax not paid, from the date of invoice till the date of payment.

I/We declare that this undertaking is given underthe orders of the properofficerforthe performance of enacts in which the publicare interested.

IN THE WITNESS THEREOF these presents have been signed the day hereinbefore written by the undertaker(s) Signature(s) of undertaker(s).

Date :

Place :

Witnesses

(1) Name and Address

(2) Name and Address

Date :

Place :

Accepted by me this.............................day of .................. (month)

................ (year) ………………………………..of …………….. (Designation)

for and on behalf of the President of India.".

Reach us at:

B C Shetty & Co.

Chartered Accountants

No.78, Sai Sharan Heights, 5th Floor, Above ICICI Bank, 15th Cross, Malleshwaram, Bangalore- 560003

Disclaimer:"The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation."

Prepared By

GST team

Happy to Help you

Contact :

Ankit C Shetty

ankit@bchsettyco.com