GST e-way Bill Process

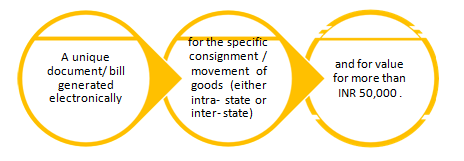

What is an E-Way Bill?

E – Way bill is an abbreviation for the words Electronic Way Bill. It is:

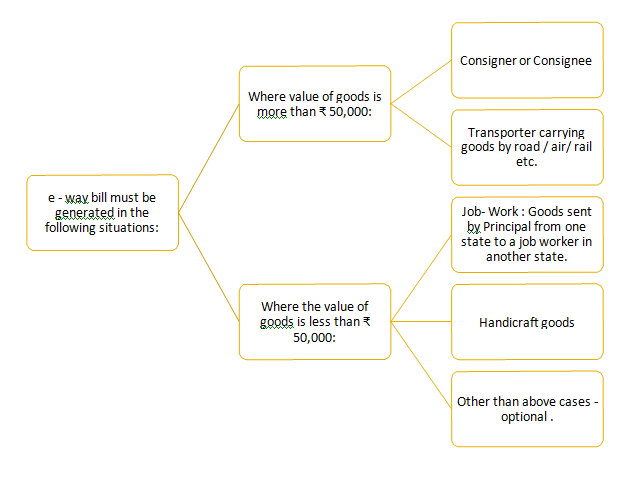

Who must issue an E-Way bill?

Scenario 1

A is a consumer. He buys goods from B and asks B to deliver it directly to C. The value of the good is ₹ 51000. Who should file an e-way bill?

Ans:Since A is an unregistered person, he can ask B to issue an e-way bill based on the bill or invoice raised to A.

A, can also enroll as a citizen and generate the e-way bill himself.

Scenario 2

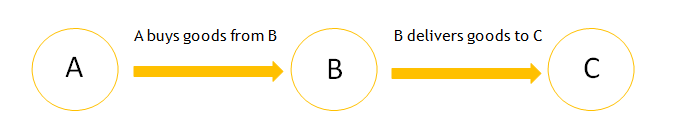

A and B are registered dealers. A buys goods from B and asks him to deliver the goods directly to C who is A’s customer. The value of the goods is ₹ 51000. How many e-way bills are required?

In this scenario, tow supplies are involved and hence ideally, 2 e-way bills should be issued:

Invoice 1 – from B to A

Invoice 2 – from A to C.

However, as per CGST Rules, 2017, either A or B can generate the e-way bill, But it has to be generated as per the following procedure:

-

IF GENERATED BY B –

- The Bill to details – will contain details of A.

- The Ship to details – will contain details of C.

-

IF GENERATED BY A-

- The Bill to details - will contain details of C.

- The Ship to details – will contain details of C.

How to generate an e-Way Bill:

An e-Way bill can be generated in the following ways:

Using Web-based system

Using SMS based facility

Using Android App

Bulk Generation facility

Using Site-to-Site Integration facility

Using GSP (Goods and Service Tax Suvidha Provider)

The most common portal for generation of e-Way bill is https://ewaybillgst.gov.in

Pre-requisites to generate an e-Way Bill:

1. Registration on the e-Way bill portal.

2. Invoice/ Bill of Supply/ Challan related to the consignment of goods.

3. Transport by Road – Transporter ID or Vehicle Number

4. Transport by Rail/ Air/ Ship – Transported ID, Transport Document Number and date on the document.

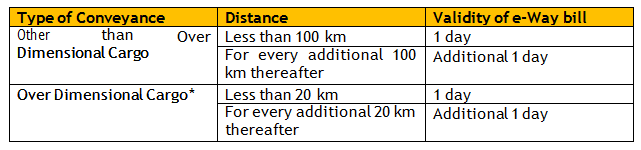

What is the validity of e-Way bills?

*Over dimensional Cargo – cargo carried as a single indivisible unit and which exceeds the dimensional rules prescribed in Rule 93 of the Central Motors Vehicle Rules 1989.

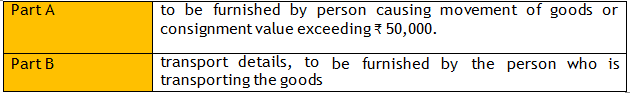

Contents of an e-Way bill:

An e-Way bill contains two parts:

Consequences of non- conformance to e-way bill rules:

he penalty will be INR 10,000 or tax evaded – whichever is greater.

Conclusion :

The e-way bill provisions under GST aim to bring in a uniform e-way bill rule which will be applicable throughout the country.

The physical interface will pave way for digital interface which will facilitate faster movement of goods and improve efficiency.

Disclaimer:"The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation."

Prepared By

Sindhu. Kini. M

Happy to Help you

Contact :

Ankit C Shetty

ankit@bchsettyco.com