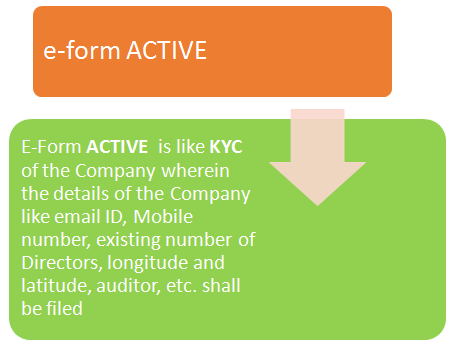

Have You Filed INC-22A / E-Form ACTIVE?

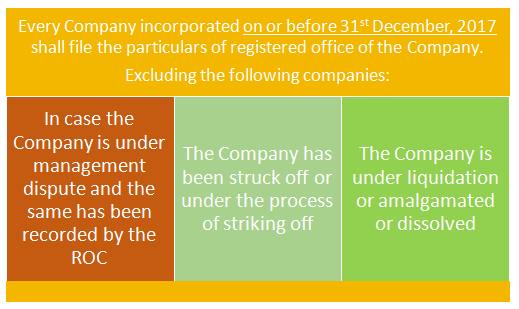

Every Company incorporated on or before 31stDecember, 2017 (excluding few categories mentioned herein below) shall file INC-22A/ e-Form ACTIVE (Active Company Tagging Identities and Verification) on or before 25.04.2019.

Services like service provided by Goods Transport Agency, Sponsorship Services, Import of Services etc., are covered under RCM.

Why Should You File E-Form ACTIVE/INC-22A?

The Ministry of Corporate Affairs has come up with the KYCs of registered office of the Companies wherein Rule 25A has been inserted in the Companies (Incorporation) Rules, 2014 after Rule 25 that shall come into force w.e.f. 25th February 2019 vide notification dated 21stFebruary, 2019.

Applicability:

Further, it is important to note that the Company which has not filed its financial statements (e-Form AOC-4) or annual returns (e-Form MGT-7) or with both shall be restricted from filing e-Form ACTIVE. Accordingly, every Company must complete its pending annual filing.

Consequences Of Non-Filing Of The Form

- The Company shall be remarked as “ACTIVE-non-compliant.

- Penalty of Rs. 10,000/- in case filed after due date.

-

The Company shall not be able to file the following e-Form:

- SH-07 (Change in Authorised Capital)

- PAS-03 (Change in Paid up Capital)

- DIR-12 (Changes in Director except cessation)

- INC-22 (Change in Registered office)

- INC-28 (Amalgamation, De-merger, etc.)

Contents Of The E-Form ACTIVE/ INC-22A

- Latitude and Longitude of the registered office.

- E-mail ID and Mobile number wherein an OTP shall come.

- Listing status of the Company.

- Particulars of the Directors of the Company as on date [Ensure that DIN of none of the Directors is “Disqualified u/s 164(2)” or “De-activated due to non-filing of DIR-3KYC”].

- Details of statutory auditor of the Company wherein particulars such as PAN, name, membership number of statutory auditor and period for which the auditor is appointed shall be filled in.

- Details of cost auditor wherein particulars such as PAN, name, membership number of auditor and period for which the cost auditor is appointed shall be filled in.

- Details of Managing Director, CEO and Company Secretary.

- SRNs of e-Form AOC-4, AOC-4 XBRL and MGT-7 shall be filled.

Other Requirements Of The Form

- The photograph of registered office showing external building and inside office also showing therein atleast one Director/KMP who has affixed his/her Digital Signature to this form shall be attached to the Form.

- Digital Signature is to be affixed on the Form by any one director (in case of OPC) and by one director and one KMP or two directors (in case of other companies).

- The Form is required to be digitally certified by Practicing Professional.

Disclaimer:"The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation."

Prepared By

Kavya P K

Happy to Help you

Contact :

Ankit C Shetty

ankit@bchsettyco.com