Sec 194-IC – TDS Implication on Joint Development Agreements

The Finance Act, 2017 has introduced a new section 194-IC w.e.f 1st April, 2017. This Section deals with TDS on payment under Joint Development Agreement (JDA).

Joint Development Agreement is a registered agreement where a landowner agrees to allow a developer to develop a real estate project.

The consideration can be in the form of:

- Cash (or)

- Percentage of developed property (or)

- Both

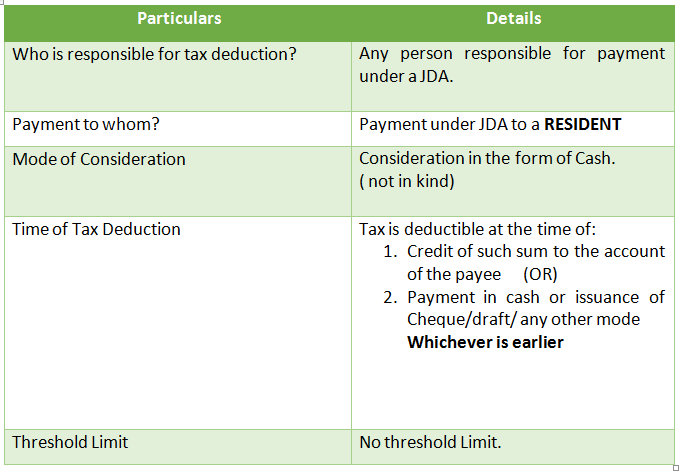

PROVISIONS OF Sec. 194-IC:

RATE OF TDS:

Which Form is used to file TDS return and payment under this section?

TDS Return is filed through Form 26Q and payment is made through Challan No 281 and nature of payment as 4IC.

What is the treatment of refundable security deposit given by developer to owner? Does that also suffer TDS?

Refundable security deposit does not attract TDS (however if it is non-refundable it attracts TDS under Sec 194IC). It is clearly specified us 194 IC that tds is required to be deducted only in respect of consideration not of security.

ILLUSTRATION:

X, owner of a piece of land enters into a JDA with Y who is a developer. X confers developmental rights to Y to construct apartments.

Y agrees to pay consideration for those development rights in the following manner:

- 40% of built up area.

- ₹10,00,000.

TAX IMPLICATIONS FOR THE ABOVE TRANSACTION:

As per Sec.194-IC, Tax will be deducted only on the consideration paid in Cash. Hence, TDS (assuming PAN is available) = 10% of ₹10,00,000

= ₹10,000

Declaration :

“The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received, or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation.”

Prepared By

Sindhu. Kini. M

Reviewed By

Phalgun

Happy to Help you

Contact :

Ankit C Shetty

ankit@bchsettyco.com