SERVICES COVERED UNDER REVERSE CHARGE MECHANISM UNDER GOODS AND SERVICES TAX ACT,2017

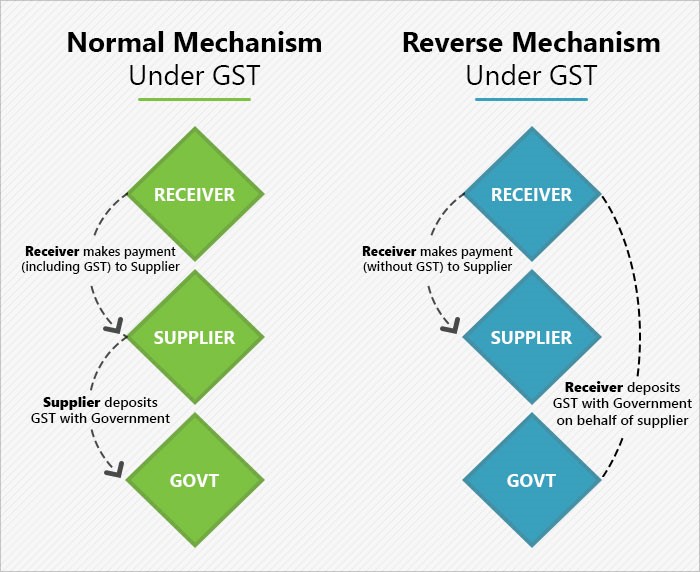

What is Reverse Charge Mechanism?

Existing List of Services on which tax is payable on RCM:

Services covered under Reverse Charge Mechanism before 1st Oct 2019.

Notifications on amendment/addition to RCM services under Goods and Service Act:

1.GST Council in its 37th meeting held on 20.09.2019 vide Notification No. 22/2019-Central Tax (Rate) dated 30th September, 2019 bring the following changes in the list of RCM services:

Amendment to existing service

Sl. No 12 as per above table will be substituted with below:

Additional Services inserted under RCM:

2. GST Council vide Notification No. 29/2019-Central Tax (Rate) dated 31st December, 2019 bring the following changes in the list of RCM services:

Amendment to existing service mentioned above:

For “Services provided by way of renting of a motor vehicle provided to a body corporate” related service, following will be substituted:

The employer’s responsibility does not end at just collecting documents. But he must also verify the legitimacy of the documents and the deduction or exemption claimed. Employee also must fulfill his obligation by submitting the proper documents to his employer.

Disclaimer:“The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received, or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation.”

Prepared By

Rutu M Doshi

Date: 10/03/2020