Capital Gains Exemption-Section 54 of income tax act

Are you planning to buy a new house with your capital gains? Then, learn all about the tax exemption of sec-54, you can save your tax.

What Is Section 54 of the Income Tax Act?

Section 54 of the Income Tax Act 1961 allows an individual and a Hindu Undivided Family (HUF) avail tax exemptions from capital gain invested in eligible transactions such as the purchase or construction of new residential house property.

1)Capital asset: What is it?

capital assets are significant pieces of property such as homes, cars, investment properties, stocks, and bonds etc,

As per the Income Tax Act 1961, capital assets are divided into two types:

- Short-term Capital Assets (STCA) with a holding period of up to 24 months

- Long-term Capital Assets (LTCA) with a holding period of over 24 months

2)What is capital gain?

When a short-term or a long-term asset is bought for Rs X and later sold for Rs X+Y, then the capital gain is Rs Y. When a short-term asset is sold, it is called short-term capital gain. When a long-term asset is sold, the gain is called long-term capital gain. Tax is charged on Rs Y.

Here we must understand 2 things.

- When we get gain from short term capital gain, we should pay the tax as per our slab rate.

- When we get gain from long term capital gain, we must pay tax on gain 20%, in LTCG we get another benefit that is indexation benefit.

What is this indexation?

As per Section 112 of the Income Tax Act, LTCG on the sale of immovable property in India is taxable at 20% with an indexation benefit. To take the indexation benefit, the taxpayer can calculate the indexed cost of the acquisition using Cost Inflation

Index

Example : Mr. Satrujith

| Particulars | Year of purchase | Amount | Profit |

|---|---|---|---|

| Building purchased | 2010 | 2,00,000 | 4,00,000 |

| Building sold | 2017 | 6,00,000 |

| Cost of purchase | Cost * Indexation rate on year of sale / Indexation rate on year of purchase |

| Indexation Rate | |

|---|---|

| 2010-2011 | 167 |

| 2017-2018 | 272 |

| Cost of the building | 2,00,000*272/167 | 325749 |

| Particulars | Amount |

|---|---|

| Building sold | 6,00,000 |

| Building purchased | 3,25,749 |

| profit | 2,74,251 |

Deductions U/s 80C to 80U can’t be availed in long term capital gain

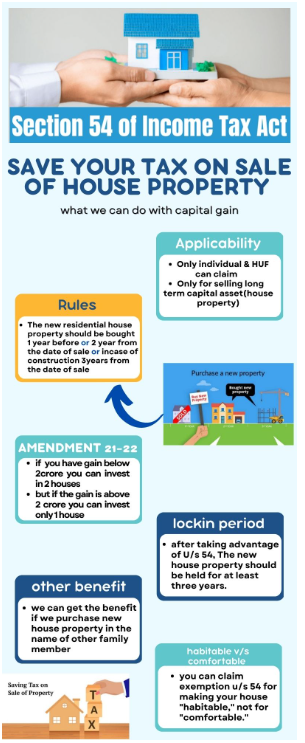

Who is eligible to avail the benefits under Section 54?

- Only individual and HUF can claim this benefit.

- Only for selling long term capital (Residential house property) example 1.

- The house property that is bought should be in India.

- The new residential house property should be purchased 1 year before or 2 years after, in case of construction of new house 3 years after

- Should be deposit capital gain amount to Capital gain accounts scheme.

- Capital gain exceed Rs. 2 crores = invest in only one property, doesn’t exceed 2 crore – one or two at the option of the assessee

- Lock-in period for one property is 3 years,

If any of the above conditions are not fulfilled by the individual, he or she is not liable to claim an exemption under section 54 of the income tax act. Only such transaction by the taxpayer is eligible for availing the exemption under section 54.

How much amount can we claim exemption u/s 54.

Investment in the new asset or capital gain, whichever is low.

Example:

- Mr. Sai purchased a residential house for 7,00,000 in April 2021 and sold the same in April 2022 for Rs. 8,00,000. Capital gain arising on sale of house amounted to Rs. 1,00,000. Can he claim benefit of section 54 by purchasing/constructing another residential house from the capital gain of Rs.

1,00,000?

Ans : No section 54 exemption only for long term capital gain - Mr. Palani sold his residential house on January 02, 2023, for Rs.10 crores which was purchased by him 10 years ago for Rs. 8 crores. Mr. Palani bought a new residential house on February 01, 2022, and on March 01, 2024, worth Rs. 1 crore each.

Ans : Yes, he can claim the exemption from section 54.

With effect from Assessment Year 2021-22, a taxpayer has an option to make investment in two residential house properties in India to claim section 54 exemption. This option can be exercised by the taxpayer only once in his lifetime provided the amount of long-term capital gain does not exceed Rs. 2 crores.

Case study:

- Whether exemption U/s 54 is available to the assessee if the new asset is purchased in the joint name of the assessee together with same family member such as husband, wife, daughter, son, or legal heir?

He/she is entitled to full exemption U/s54 even if property has been purchased in the joint name with other family member.

Lakshmi Narayan v/s Rajasthan high court – 07-11-2017 (wife) On the ground of investment made by the assessee in the name of his wife, he is entitled to full exemption.

The Rajasthan high court the word used is assessee has to invest it is not specified that it is to be in the name of the assessee.

- Whether after purchasing of residential house expenditure incurred on making the house habitable would also qualify for deduction U/s 54 and 54F

Saleem Fazebhoy v/s CIT (commissioner of income tax) (2006)

Held that expenditure incurred in making of the house habitable will also qualify for exemption U/s 54 and 54F as unless a house purchased is fit enough for living, it can’t be said to be residential,

However, no exemption is allowable if expenditure is incurred to make the house comfortable as there is no difference between ‘habitable’ and ‘comfortable’.

What if we purchase semi-finished

In case of semi-finished goods house, the purchaser will have to invest on flooring, wooden work, sanitary work etc, to make it habitable in the case of (Mrs Sonia Gulati v/s ITO case)2001.

Disclaimer:

“The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received, or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation.”

Prepared by, Madhu.M

CA Article assistant

BC shetty and co

Prepared On:

1/08/23

Please Share: