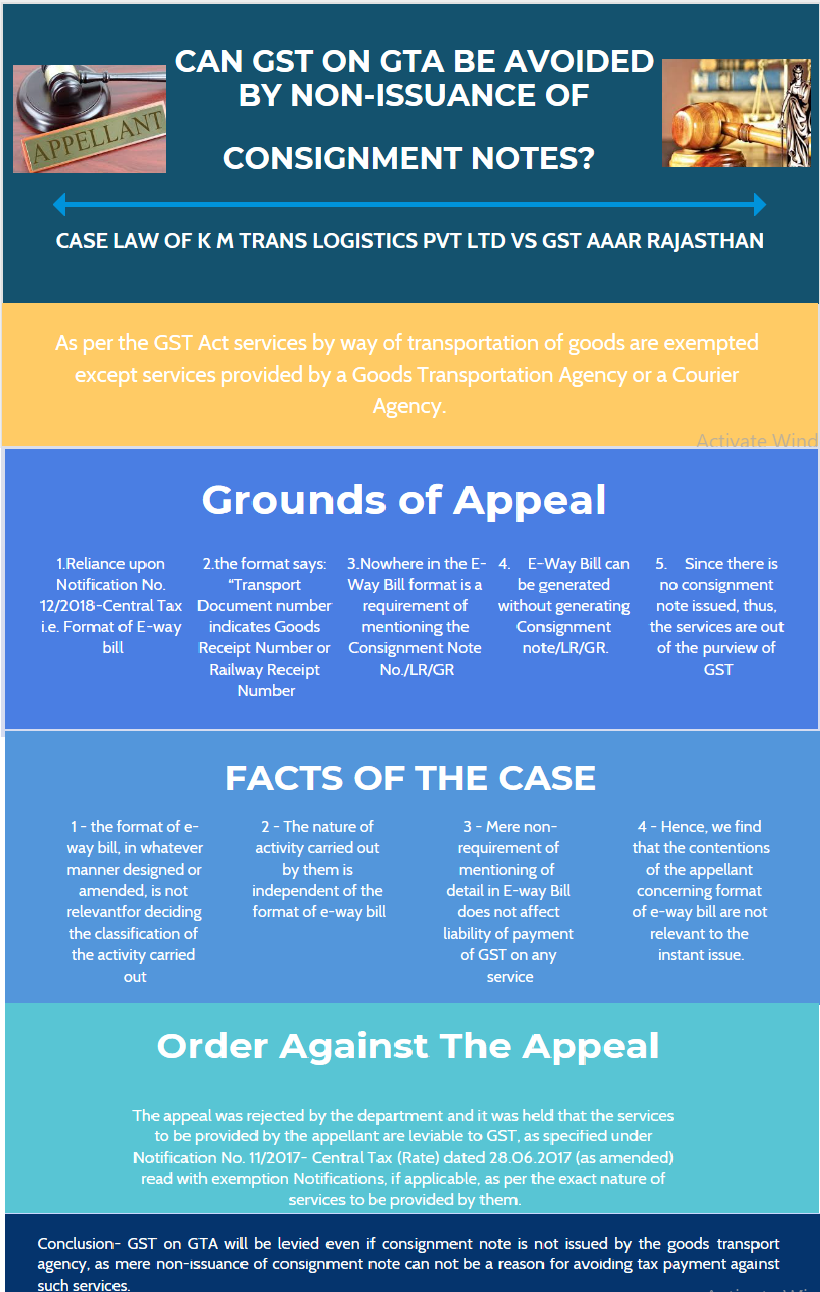

GST ON GTA CAN’T BE AVOIDED BY NON-ISSUANCE OF CONSIGNMENT NOTE

Goods Transport Agency (GTA)

“Goods transport agency” or GTA means any person who provides service in relation to transport of goods by road and issues consignment note, by whatever name called.

This means, while others might also hire out vehicles for goods transportation, only those issuing a consignment note are considered as a GTA. Thus, a consignment note is an essential condition to be considered as a GTA.

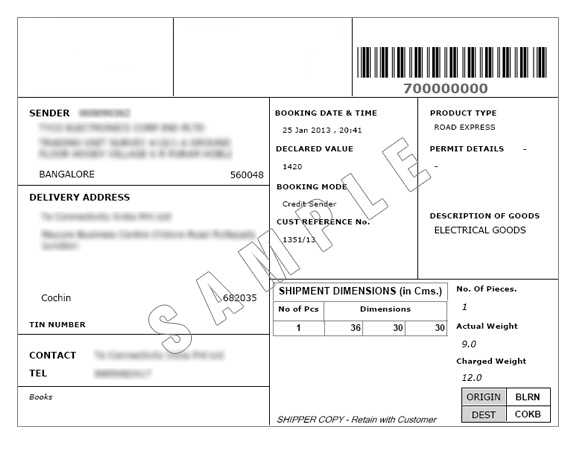

Consignment Note

A consignment note is a document issued by a goods transportation agency against the receipt of goods for the purpose of transporting the goods by road in a goods carriage. Below is the sample of consignment note: -

GST Applicability on Transport of Goods

Services by way of transportation of goods are exempted:

-

(a) by road except the services of:

- (i) a goods transportation agency.

- (ii) a courier agency

- (b) by inland waterways.

There are two types of services involved in transportation of goods: -

1. By way of activity described as goods transport agency’ services

2. By way of rental services of transport vehicles can be provided

If the lien of the goods is transferred and the transporter becomes responsible for the goods till its’ safe delivery to the consignee, the services will be classifiable as goods transport agency services.

However, if the vehicles are provided to the client on rental for use as per their requirement, the services will be classifiable as ‘rental services of transport vehicles’.

In case of services classified as Goods Transport agency services, it will be liable under GST for payment of GST on the taxable value of services. Issuance of consignment note, or its non-issuance does not make any difference so far as the nature of the activity is carried out by them is concerned. Mere non-issuance of the consignment note in such cases does not make them entitled for exemption from payment of GST.

Case Law: K M Trans Logistics Private Limited Vs GST AAAR Rajasthan

In the given case law appellant was providing services to various manufacturers of motor vehicles in transporting the vehicles from their factories to their authorised dealers in various cities in India. Appellant was carrying e-way bill during the transportation service as notified in Notification, No. 12/2018-Central Tax, dated 07.03.2018.

Appeal by the client:

K M Trans Logistics Private Limited was appealing their services of transporting vehicles as non-taxable supply of services under GST as they were not carrying any consignment note and these services cannot be classified as Goods Transport Agency Services.

The appellant has further contended that nowhere in the E-Way Bill format it is required to mention the Consignment Note No./LR/GR issued by Goods Transport Agency or transporter and E-Way Bill can be generated without generating

Consignment note/LR/GR and since there is no consignment note issued, thus, the services are out of the purview of GST and will categorize as non-taxable service.

Grounds of Appeal:

-

The appellant has mentioned the following grounds of Appeal:

- 1. Appellant was placing reliance upon the Notification No. 12/2018-Central Tax, dated 07/03/2018. Through this Notification, the format of E-Way Bill was reproduced along with notes appended to the format of E-way Bill in the impugned order of the Rajasthan Authority for Advance Ruling which is not correct. Note No. 2 of E-Way Bill had wrongly been quoted leading to misinterpretation of the requirement of details at column referring “Transport Document Number”.

- 2. The Transport Document No. as required at point B.2 of Part B of the E-Way Bill is described at Note 3 of the notes appended to the format says: “Transport Document number indicates Goods Receipt Number or Railway Receipt Number or Forwarding Note number or Parcel way bill number issued by railways or Airway Bill Number or Bill of Lading Number”.

- 3. Nowhere in the E-Way Bill format is a requirement of mentioning the Consignment Note No./LR/GR issued by Goods Transport Agency or transporter. Thus, there is no requirement of mandatory issuing consignment note or LR/GR by the transporter.

- 4. E-Way Bill can be generated without generating Consignment note/LR/GR. Presently the E-Wav Bills are generated on the GST portal without mentioning of Consignment note /LR/GR.

- 5. Since there is no consignment note issued, thus, the services are out of the purview of GST and will categorize as non-taxable service/ non-GST supply.

Facts of the case:

We find that the format of e-way bill, in whatever manner designed or amended, is not relevant for deciding the classification of the activity carried out by them. The nature of activity carried out by them is independent of the format of e-way bill rather e-way bill format has no connection whatsoever, with the nature of activities undertaken. In any case, mere non-requirement of mentioning of any detail in E-way Bill does not affect liability of payment of GST on any service unless the service has been exempted through an exemption Notification issued by the Government. Hence, we find that the contentions of the appellant concerning format of e-way bill are not relevant to the instant issue.

Order of the appeal

The appeal was rejected by the department and it was held that the services to be provided by the appellant are leviable to GST, as specified under Notification No. 11/2017- Central Tax (Rate) dated 28.06.2017 (as amended) read with exemption Notifications, if applicable, as per the exact nature of services to be provided by them.

Disclaimer:“The information contained herein is only for informational purpose and should not be considered for any particular instance or individual or entity. We have obtained information from publicly available sources, there can be no guarantee that such information is accurate as of the date it is received or it will continue to be accurate in future. No one should act on such information without obtaining professional advice after thorough examination of particular situation.”

Prepared By

A Satish Kumar Sarab

CA Final

Date: 03/05/2020